Case Analysis of Company Capital Reduction

One Background

A certain limited liability company (hereinafter referred to as "Company A") is a foreign-invested enterprise, and its shareholder is a Hong Kong company. At present, there is A gap of approximately one million US dollars between the registered capital and the paid-in capital of Company A. According to the currently valid articles of association, shareholders should fully pay up the registered capital within 15 years from the date of issuance of the business license (2018), that is, complete the capital contribution before 2033. Recently, Company A has learned that its shareholders have no intention of continuing to inject capital into the company. Now, it is necessary to explore the feasibility and operational path of reducing capital or adjusting the contribution period.

Two Core legal bases

In accordance with the Company Law of the People's Republic of China revised in 2023 (hereinafter referred to as the "Company Law") and the Provisions of The State Council on the Implementation of the Capital Registration Management System of the Company Law of the People's Republic of China (hereinafter referred to as the "New Provisions") issued in 2024, the core provisions are as follows:

Article 47 of the Company Law: Shareholders shall fully pay up their capital contributions within five years of the establishment of the company.

Article 266 of the Company Law: Where the capital contribution period of an existing company exceeds the legal period, it shall be gradually adjusted to the legal period.

Article 2 of the new "Regulations" : For companies established before June 30, 2024, if the subscribed capital period exceeds five years from July 1, 2027, it should be adjusted to within five years by June 30, 2027, and recorded in the company's articles of association.

Article 214 and Article 225 of the Company Law: After a company has made up for its losses, it may adjust its registered capital through a proxy method.

Three The impact of the three legal provisions on Company A

• Obligation to adjust the contribution period: According to the articles of association of Company A, shareholders of Company A should fully pay their capital contributions by 2033. According to the new "Regulations", if the contribution period exceeds June 30, 2032 (July 1, 2027 +5 years), the articles of association must be revised before June 30, 2027, shortening the contribution period to within 5 years. Therefore, Company A needs to adjust its articles of association accordingly.

Feasibility of capital reduction: If it is determined that shareholders have no intention of continuing to inject capital, direct capital reduction can also be considered to adjust the scale of registered capital and effectively reduce the capital contribution pressure on shareholders.

Four Operation Plan for Adjusting the Contribution period

1. Attention should be paid to foreign-invested enterprises

Article 44, Paragraph 2 of the Implementing Regulations of the Foreign Investment Law: As of January 1, 2025, for existing foreign-invested enterprises that have not lawfully adjusted their organizational forms, organizational structures, etc., and completed the change registration, the market supervision and administration departments shall not handle other registration matters they apply for, and shall make the relevant circumstances public.

As A foreign-invested enterprise, Company A should first pay attention to whether it has changed its organizational form and structure in accordance with the Foreign Investment Law (with a focus on the highest authority, the way the legal representative or directors are elected, and the mechanism for deliberation and voting, etc.). Only after the above matters have been changed can other registration matters (such as adjusting the capital contribution period) be changed.

2. Adjust the contribution period and file it for record

Convene a shareholders' meeting and make a resolution on "adjusting the capital contribution period", and accordingly amend the company's articles of association. Subsequently, the resolution of the shareholders' meeting and the articles of association (or the amendment to the articles of association) shall be submitted to the Market Supervision and Administration Bureau for record.

Five Types of capital reduction and Applicable scenarios

1. General capital reduction (in accordance with Article 224 of the Company Law [1]

• Applicable circumstances: Reduce the obligation of shareholders to make unpaid capital contributions.

• Features: It is necessary to go through the procedure of "notifying creditors + making an announcement", and creditors have the right to demand that the company repay debts or provide corresponding guarantees.

The total registered capital of the company is 10 million yuan, and the shareholders have actually paid in 5 million yuan. If the capital is reduced by 3 million yuan, shareholders will only need to pay an additional 2 million yuan in the future.

2. Formal capital reduction (in accordance with Article 225 of the Company Law [2])

• Applicable circumstances: It is used to make up for the company's losses.

• Features: It is only deducted from the paid-in capital, does not affect the shareholders' unpaid capital contribution obligations, and has relatively low requirements for creditor protection.

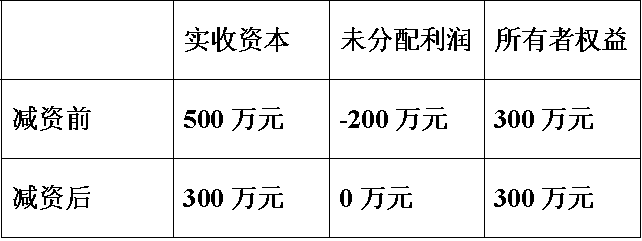

The total registered capital of the company is 10 million yuan. The shareholders have actually paid in 5 million yuan, but the company has suffered a loss of 2 million yuan. To make up for the loss of 2 million yuan, the paid-in 5 million yuan was reduced to 3 million yuan through capital reduction. The company will no longer suffer losses, but at the same time, shareholders still have to continue to bear the subsequent subscribed capital contribution obligation of 5 million yuan. As shown in the following table

Note: As the formal capital reduction does not actually decrease the company's capital (the owner's equity remains unchanged), it will not harm the interests of creditors. Therefore, there is no need to notify creditors or follow the creditor objection procedure.

Six General Operating procedures for Capital reduction

Prepare the balance sheet and property list, and form the "Financial Accounting Report" or "Audit Report"

Article 224, Paragraph 1 of the Company Law: When a company reduces its registered capital, it shall prepare a balance sheet and a list of assets.

2. Formulate the "Capital Reduction Plan" and have it approved by the board of directors, shareholders/shareholders' meeting

Article 66 of the Company Law: Resolutions of the shareholders' meeting to amend the articles of association, increase or decrease the registered capital, as well as to merge, split, dissolve the company or change the form of the company, shall be passed by shareholders representing more than two-thirds of the voting rights.

Article 67 of the Company Law: A limited liability company shall have a board of directors, except as otherwise provided for in Article 75 of this Law. The board of directors shall exercise the following powers and functions:... (V) Formulate plans for increasing or decreasing the company's registered capital and issuing corporate bonds... .

3. Notify creditors and make public announcements, settle debts or provide guarantees (the form of capital reduction procedures is relatively simple)

• General capital reduction

Article 224, Paragraph 2 of the Company Law: A company shall notify its known creditors within ten days from the date of the shareholders' meeting's resolution to reduce its registered capital and make an announcement in the newspaper or on the National Enterprise Credit Information Publicity System within thirty days. Creditors have the right to demand that the company settle its debts or provide corresponding guarantees within 30 days from the date of receiving the notice, or within 45 days from the date of the announcement if they have not received the notice.

• Formal capital reduction

Article 225, Paragraph 2 of the Company Law: Where the registered capital is reduced in accordance with the provisions of the preceding paragraph, the provisions of Paragraph 2 of the preceding article shall not apply, but an announcement shall be made in the newspaper or on the National Enterprise Credit Information Publicity System within 30 days from the date when the shareholders' meeting makes a resolution to reduce the registered capital.

4. Sign and fulfill the "Capital Reduction Agreement", amend the company's articles of association and have them approved by the shareholders' meeting

Article 66 of the Company Law: Resolutions of the shareholders' meeting to amend the articles of association, increase or decrease the registered capital, as well as to merge, split, dissolve the company or change the form of the company, shall be passed by shareholders representing more than two-thirds of the voting rights.

5. Handle industrial and commercial registration and tax change registration

It is recommended to handle the industrial and commercial change registration and tax change registration in a timely manner after the expiration of the announcement period (45 days). As the processing procedures vary from place to place, it is suggested to communicate with the market supervision and tax authorities in advance before handling.

Seven Matters to Note when reducing capital by taking advantage of losses

1. In terms of the process, losses cannot be directly offset through "capital reduction"

The operation should first be carried out in accordance with the method of making up for the loss of provident fund as stipulated in Article 214 of the Company Law [3]. The new Company Law does not stipulate the methods and details for making up for losses. (Based on current practical understanding, not all capital reserves can be made up. The premium of shareholders' capital contributions, cash donations received by the company, and specific fiscal appropriations, which have actual investments, are more feasible for making up for losses. However, changes in the accounts due to special accounting treatments are highly unlikely to be used to make up for losses.) Enterprises should consult the specific opinions of the local competent authorities before implementation.

2. After the capital reserve has been made up

The company can continue to make up for losses through capital reduction, that is, to carry out a formal capital reduction in accordance with Article 225 of the Company Law, that is, to reduce the paid-in registered capital. At the same time, there will be no losses on the financial statements. However, at this time, the 1 million US dollars that the shareholders have not fulfilled their paid-in obligations should still be fulfilled. After completing the aforementioned form of capital reduction, a general capital reduction can be carried out in accordance with Article 224 of the Company Law. After the capital reduction, shareholders no longer have the obligation to actually pay 1 million yuan. However, it should be reminded to shareholders that creditors have the right to demand security or early repayment.

3. Where capital is reduced to cover losses, dividends shall not be distributed at will subsequently

After the capital reduction to cover losses, the formal capital reduction actually lowers the threshold for the company to distribute profits to shareholders, indirectly affecting the interests of creditors. A company shall, in accordance with the law, set aside 10% of its profits as the statutory reserve fund when distributing profits. With the resolution of the shareholders' meeting, it may also set aside discretionary reserve funds. Dividends shall not be distributed until the statutory reserve fund and discretionary reserve funds reach 50% of the registered capital. [4] This regulation is mainly aimed at preventing shareholders from abusing the practice of "reducing capital to cover losses" to carry out unreasonable dividend distribution. To ensure that the company maintains normal operations after capital reduction and is not depleted by shareholders' dividends, it is necessary to keep a certain amount of funds in the company's accounts before distributing dividends.

Eight Tax treatment for two types of capital reduction methods

1. General capital reduction

If only the capital contribution obligation is reduced and the subscribed registered capital is decreased (without substantial capital reduction) : In the case of reducing the subscribed capital contribution, the amount of paid-in capital of the invested enterprise will not change, and no capital reduction consideration needs to be paid to the shareholders. Therefore, there will be no corresponding income tax impact on either the invested company or the shareholders.

2. Substantial capital reduction

If the shareholder obtains the corresponding capital reduction income from the invested enterprise (substantive capital reduction) :

Article 5 of the "Announcement of the State Administration of Taxation on Several Issues Concerning Enterprise Income Tax" (Announcement No. 34 of 2011 of the State Administration of Taxation) stipulates that when an investing enterprise withdraws or reduces its investment from an investee, the portion of the assets it acquires that is equivalent to the initial investment shall be recognized as investment recovery. The portion equivalent to the accumulated undistributed profits and accumulated surplus reserves of the invested enterprise calculated based on the proportion of the reduction in paid-in capital should be recognized as dividend income. The remaining part is recognized as gains from the transfer of investment assets.

In 2018, Company A invested 5 million yuan in Company B, becoming a shareholder of the company and holding 10% of its shares. In 2020, Company A divested its 10% stake in Company B. At the time of divestment, the total amount of undistributed profits and accumulated surplus reserves on the books of Company B was 16 million yuan, while Company A actually received 8 million yuan in cash.

The first step is to confirm that the investment recovery = 5 million yuan.

The second step is to confirm the dividend income as 1,600 ×10% = 160 (ten thousand yuan) (domestic enterprises are exempt from enterprise income tax).

Step 3: Confirm the gain from the transfer of investment assets = 800-500-160 = 140 (ten thousand yuan)

For domestic enterprises, according to Article 26 of the Enterprise Income Tax Law, dividends, bonuses and other equity investment income obtained by enterprises from resident enterprises that meet the conditions are tax-exempt income. Therefore, only the income from the transfer of investment assets in the third step needs to be included in the taxable income for the calculation and payment of enterprise income tax.

For non-resident shareholders of overseas enterprises, the dividends from the second step are not eligible for tax exemption. Both the dividend income from the second step and the investment transfer income from the third step usually need to pay the corresponding withholding income tax. The specific amount needs to be determined based on the nature of the income and by referring to the preferential tax treatment stipulated in the relevant tax treaties.

3. Formal capital reduction

In actual operation, some tax authorities believe that making up losses with paid-in capital involves shareholder donations or should be recognized as income for the calculation and payment of enterprise income tax. However, there is also the view that the formal capital reduction is essentially an adjustment of the amounts of the "Paid-in Capital" and "Undistributed Profits" accounts under the owner's equity account of the balance sheet. Neither shareholders nor the company generate any income, and thus no corresponding income tax needs to be paid.

Note:

As capital reduction involves multiple authorities such as industry and commerce and taxation, and there are certain differences in operational standards across regions, it is recommended that a well-designed plan be made before implementation, and sufficient communication be conducted with local regulatory authorities to ensure full compliance throughout the process.

Footnote

Article 224 of the Company Law: When a company reduces its registered capital, it shall prepare a balance sheet and a list of assets.

The company shall notify its creditors within ten days from the date when the shareholders' meeting makes a resolution to reduce its registered capital, and make an announcement in the newspaper or on the National Enterprise Credit Information Publicity System within thirty days. Creditors have the right to demand that the company settle its debts or provide corresponding guarantees within 30 days from the date of receiving the notice, or within 45 days from the date of the announcement if they have not received the notice.

When a company reduces its registered capital, it shall reduce the amount of capital contribution or the number of shares held by the shareholders in proportion to their capital contribution or shareholding, except as otherwise provided by law, agreed upon by all shareholders of a limited liability company, or as otherwise provided in the articles of association of a joint stock limited company.

[2]. Article 225 of the Company Law: If a company still has losses after making up for them in accordance with the provisions of the second paragraph of Article 214 of this Law, it may reduce its registered capital to make up for the losses. Where the registered capital is reduced to make up for losses, the company shall not distribute it to the shareholders, nor shall it relieve the shareholders of their obligation to pay the capital contribution or share price.

Where the registered capital is reduced in accordance with the provisions of the preceding paragraph, the provisions of the second paragraph of the preceding article shall not apply, but an announcement shall be made in the newspaper or on the National Enterprise Credit Information Publicity System within 30 days from the date when the shareholders' meeting makes a resolution to reduce the registered capital.

After a company reduces its registered capital in accordance with the provisions of the preceding two paragraphs, it shall not distribute profits until the accumulated amount of the statutory reserve fund and the discretionary reserve fund reaches 50% of the company's registered capital.

[3]. Article 214 of the Company Law: The reserve fund of a company shall be used to make up for the company's losses, expand the company's production and operation or be converted into an increase in the company's registered capital.

When using the provident fund to cover the company's losses, the discretionary provident fund and the legal provident fund should be used first. If it still cannot be made up for, the capital reserve fund may be used in accordance with the regulations.

When the legal reserve fund is converted into an increase in registered capital, the remaining portion of such reserve fund shall not be less than 25% of the company's registered capital before the conversion.

[4]. Same as [2].