Evergrande's filing for "bankruptcy protection" in the US is not related to bankruptcy liquidation?

Since September 28, 2023, China Evergrande (03333.HK) issued a notice in the Hong Kong Stock Exchange that "the company has received a notice from relevant departments that Hui Ka Yan, the executive director and chairman of the board of directors of the company, has been taken compulsory measures in accordance with the law for suspected crimes". All the rumors about the current situation of Hui Ka Yan, the actual controller of Evergrande Group, finally came to light. Evergrande is also getting more attention.

Recently, media reported that Evergrande Group filed for "bankruptcy protection" in the US during the restructuring of US dollar bonds, which triggered speculation and doubts from all walks of life, and even some wrong interpretation. Therefore, we briefly make the following legal analysis.

The first thing to be clear is that Evergrande's filing for "bankruptcy protection" in the United States is not a bankruptcy liquidation, nor will the process lead directly to bankruptcy liquidation.

It is not alone that real estate companies such as Evergrande Group and Sunac Group have recently filed for bankruptcy protection in the US in the process of restructuring their US dollar bonds. According to incomplete statistics by the media, a number of enterprises, including Kaisa, Modern Land and Rongsheng Development, have filed for bankruptcy protection in the US during the restructuring of US dollar bonds. Most of these issuers are registered in the Cayman Islands or Virgin Islands and stipulate in their prospectuses that U.S. or English law apply in case of disputes. It is an arrangement to promote overseas debt restructuring and a common procedure for overseas debt restructuring for such enterprises to apply to the New York court for recognition of the restructuring agreement arrangement procedures conducted by them in the Hong Kong and Cayman courts.

As for Evergrande Group, as it had agreed in advance that its US dollar debt dispute was governed by US laws, Evergrande Group applied to the US court for recognition of the overseas debt restructuring agreement arrangement under the legal system of Hong Kong and the British Virgin Islands (BVI) in accordance with Chapter 15 of Title 11 of the US Code, which is part of the normal overseas restructuring procedure and does not involve the bankruptcy application or bankruptcy liquidation procedure. Its essence is to seek the recognition and effectiveness protection of the US court for the arrangement procedure of US dollar debt restructuring agreement, so as to ensure that it will not be sued by creditors in the US or applied for execution of its assets in the US when it conducts debt restructuring outside the US. Professor Li Shuguang of China University of Political Science and Law also clearly pointed out in his authoritative interpretation that the application of Evergrande Group and other enterprises in the United States belongs to a parallel auxiliary procedure, while the completion of debt restructuring agreements in the courts of Hong Kong, Cayman and British Virgin Islands is the main procedure, which aims to avoid the adverse impact of lawsuits filed by overseas bondholders on the debt disposal plan.

At the same time, the application for bankruptcy protection will not have a direct impact on Evergrande's judicial disposal, debt restructuring and related work in China." Most of the overseas debt restructuring subjects of similar real estate groups are registered overseas, and there is multi-layer equity isolation between them and the operating subjects of specific projects in China (or project companies, the same below). Relevant restructuring arrangements will not affect the jurisdiction of the courts in China over the cases involved in the operating subjects of specific projects in China. Naturally, it will not directly affect the domestic judicial disposal, debt restructuring and guarantee the delivery of buildings and other related work.

Appendix I:

On the evening of September 28, Evergrande Real Estate Group Co., LTD. (hereinafter referred to as "Evergrande Real Estate") announced the latest outstanding debt data. According to the announcement of Evergrande Real Estate: by the end of August 2023, the company and its subsidiaries (issuers) within the scope of the merger have a total of 1,946 pending litigation cases with a target amount of more than 30 million yuan, and the total target amount is about 449.298 billion yuan. By the end of August 2023, the accumulative amount of maturing debts of issuers involved in unpaid debts is about 278.532 billion yuan; In addition, by the end of August 2023, the accumulative amount of overdue commercial notes of issuers is about 206.777 billion yuan.

Appendix II:

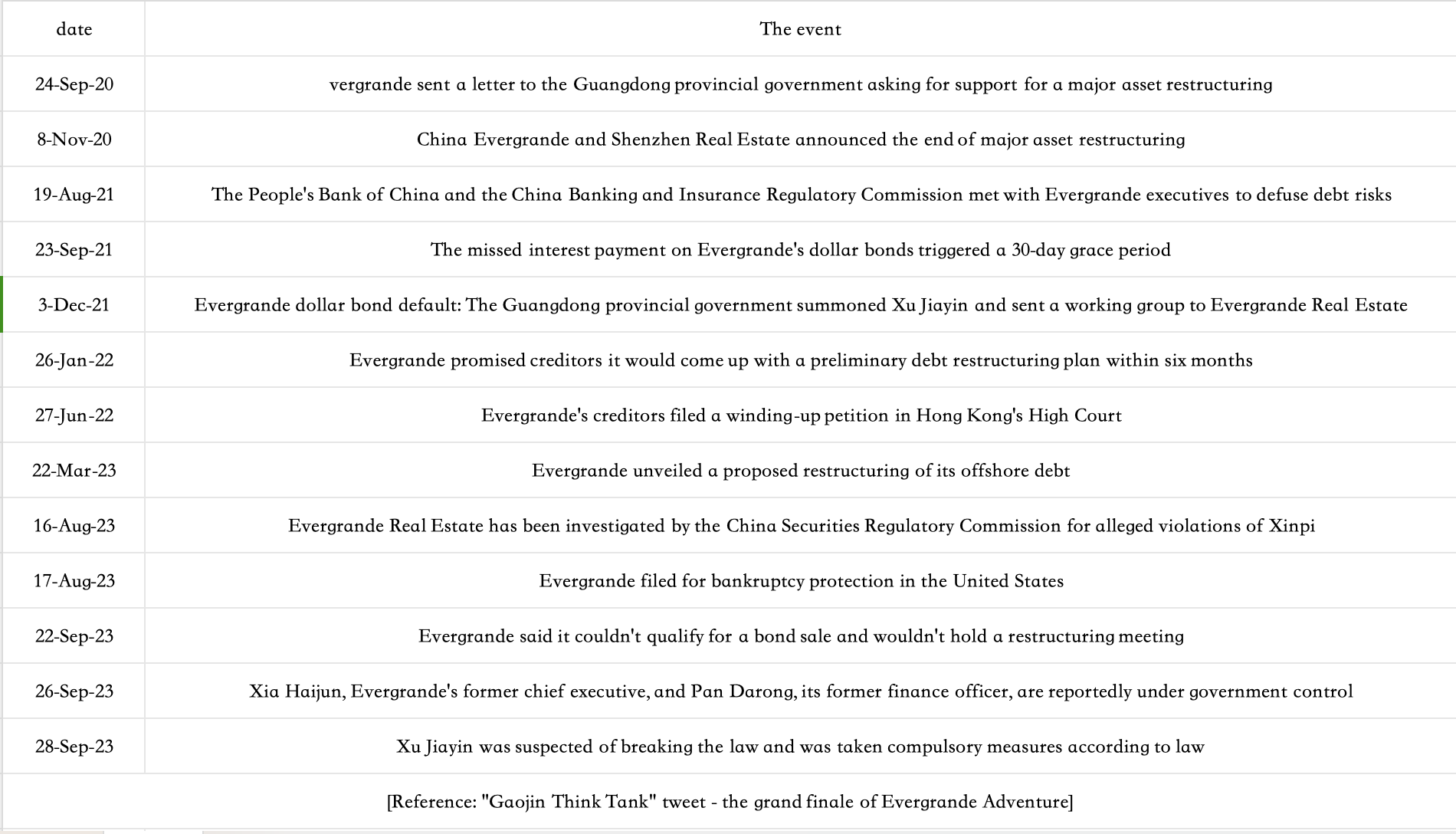

Timeline of major events

Recommended Information

-

ArticlesThe formation time of creditor's rights shall not affect the shareholders of defective capital increase to bear supplementary compensation liability2024-02-01

-

ArticlesFruit of the poisonous tree, the influence of non-competition forensics on personal information protection2024-02-01

-

ArticlesData exit 5·Compliance points of standard contract filing for personal information exit2024-02-01

-

ArticlesFocusing on the revision of civil procedure law -- the evolution and practical prospect of "Inconvenient Court" principle2024-02-01

-

ArticlesContractual energy management project dispute series · Loss of available benefits under new judicial interpretation2023-12-04