State-owned equity repurchase on the actual predicament of the transaction and legal advice

In order to protect investment returns and control investment risks, state-owned enterprises usually agree on repurchase terms in transaction documents. After the repurchase event occurs, state-owned investors have the right to exercise the repurchase right and ask the repurchase obligor to undertake the repurchase obligation. The equity repurchase of state-owned enterprises usually must comply with a series of provisions such as the Law on State-owned Assets of Enterprises, the Interim Regulations on the Supervision and Management of State-owned Assets of Enterprises, and the Interim Measures for the Evaluation and Management of State-owned Assets of Enterprises. When the relationship between state-owned investors, the target company and the actual controller turns cold, the promotion of the approach transaction will inevitably encounter difficulties in practice. This paper makes a preliminary legal analysis on the regulations, practical dilemmas and legal suggestions of state-owned equity repurchase.

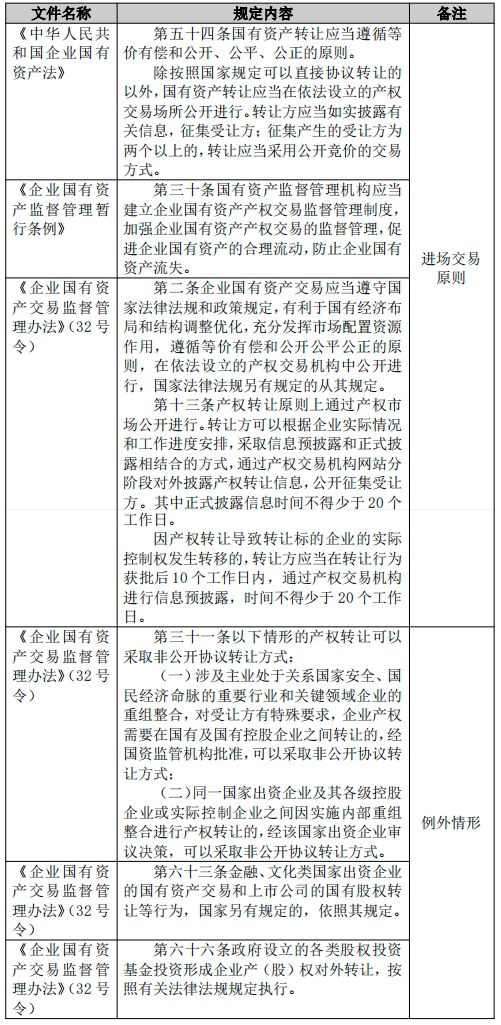

1. Provisions on the entry and transaction of state-owned assets

01. Principles and Exceptions

Based on the above table, the state-owned equity repurchase is based on the principle of entry transactions, with the exception of non-public agreement transfers.

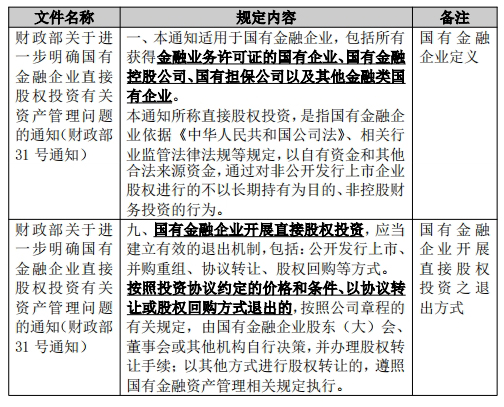

Regarding the interpretation of "Transactions of state-owned assets of financial state-funded enterprises" under the exception, and the detailed rules of "foreign transfer of property (shares) rights of enterprises invested by various equity investment funds established by the government", the author discusses the following.

02. Interpretation of "Transactions of State-owned Assets of financial state-funded enterprises"

Based on the 31st notice of the Ministry of Finance, state-owned financial enterprises to carry out direct equity investment, its exit mechanism includes agreement transfer, equity repurchase and other ways, can be withdrawn in accordance with the price and conditions agreed in the investment agreement, by agreement transfer or equity repurchase. The author believes that there are three key points here: first, the investor should meet the definition of "state-owned financial enterprises"; second, the investor's direct equity investment; third, the investment agreement has agreed on a clear buyback terms, including price, conditions and other contents.

(2021) Jingmin End No. 794 civil judgment shows that Dingdian Investment Company and Ding Shiguo (repo obligor, original defendant, appellant) claim in the lawsuit that Jilin Province Investment Group Co., LTD. (hereinafter referred to as "Jilin Investment Company", investor, original plaintiff, appellant) does not apply Notice No. 31 of the Ministry of Finance. "After checking on the official website of the China Banking and Insurance Regulatory Commission (hereinafter referred to as the CBRC), Jilin Investment Company has not obtained a financial business license, so Jilin Investment Company is a non-state-owned financial enterprise." Jilin Investment argues that it is a provincial financial enterprise and an unlicensed financial institution managed by the Jilin Provincial Department of Finance. Jilin Investment Company does not carry out special financial activities and does not need to hold a license. The so-called financial license is a certificate issued by the relevant regulatory authority to a specific financial institution to authorize it to operate a special financial business. Jilin Investment Company is only engaged in ordinary investment and financing of financial institutions, not engaged in special financial activities, no license.

The Beijing Higher People's Court held that: In this case, according to the "Notice on Issuing the Implementation Plan for the Transfer of Provincial Financial Enterprises" and submitting relevant materials and "Comprehensive Report of the Provincial Government on the Management of State-owned Assets in 2018" and other evidence materials submitted by Jilin Investment Company, it can be proved that Jilin Investment Company is a financial enterprise of Jilin Province and an unlicensed financial institution managed by the Department of Finance of Jilin Province. Its business scope covers a variety of financial investment fields. "This notice applies to state-owned financial enterprises, including all state-owned enterprises that have obtained financial business licenses, state-owned financial holding companies, state-owned guarantee companies and other state-owned financial enterprises,"Article 1 of the Ministry of Finance Notice No. 31 stipulates. Therefore, Jilin Investment Company belongs to other financial state-owned enterprises stipulated in Article 1 of the Ministry of Finance Notice No. 31. As a state-owned financial enterprise, Jilin Investment Company has the right to withdraw its investment in the target company in accordance with the share repurchase method agreed in the Investment Contract. The Investment Contract does not violate the mandatory provisions of laws and administrative regulations, and is lawful and valid.

In combination with the above cases, state-owned financial enterprises include non-licensed financial institutions engaged in ordinary investment and financing, so the statement of the Ministry of Finance Notice No. 31 on "state-owned enterprises with financial business licenses, state-owned financial holding companies, state-owned guarantee companies and other financial state-owned enterprises" is not a common prerequisite for obtaining a financial business license.

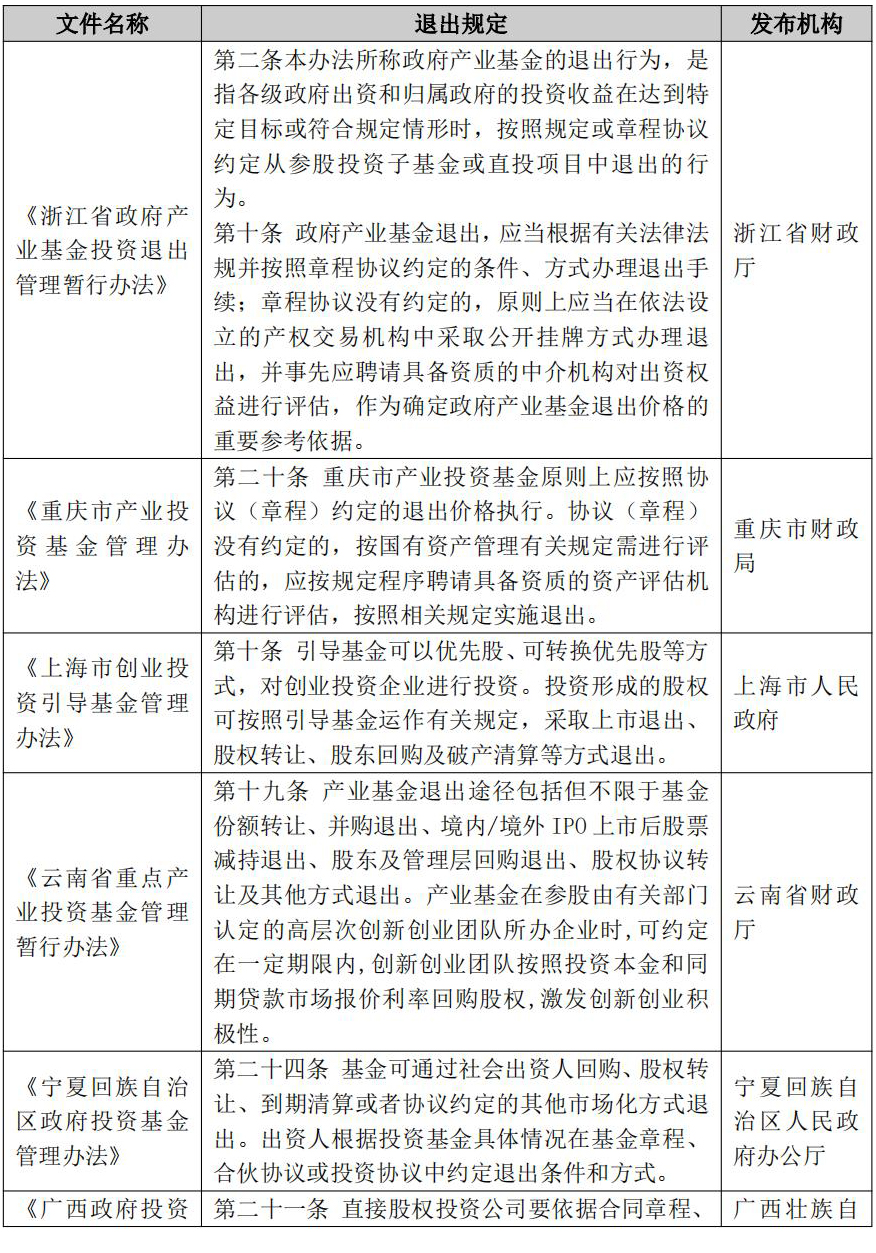

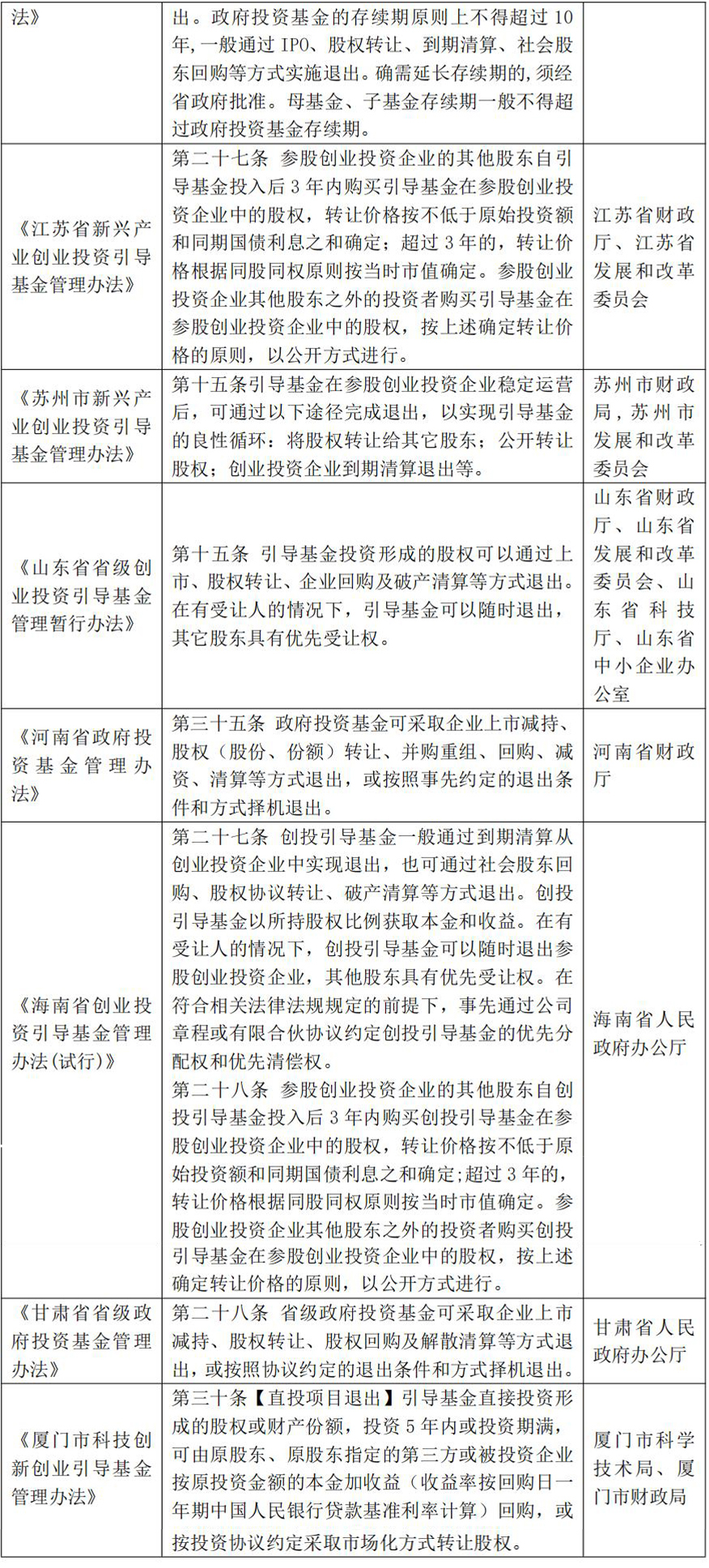

03, detailed rules on "Various types of equity investment funds established by the government to invest in the foreign transfer of property (stock) rights of enterprises"

Since the "Interim Management Measures for Government Investment Funds" only provides for the withdrawal of government investment from the investment fund, and does not specify the withdrawal of equity from the investment of government investment funds, the equity withdrawal of local government investment funds should refer to the specific rules promulgated by the author, and the incomplete search is summarized as follows.

Second, the practical dilemma and legal advice of state-owned equity repurchase transaction

01, buyback terms do not agree on state-owned equity trading procedures

In practice, if the state-owned investor does not specifically specify the relevant agreement on state-owned equity entry transaction in the buyback clause of the investment agreement, only signs the buyback clause in common format (including buyback event, buyback period, buyback price and liquidated damages), and only vaguely agrees that the parties shall make every effort to facilitate the share buyback arrangement, when the buyback event is triggered, the parties will increase the negotiation workload.

Because the investment agreement does not explicitly stipulate the transaction procedure for state-owned equity repurchase, the obligation and period of the target company to cooperate with equity evaluation and audit, and the arrangement for the target company to cooperate with local property rights trading institutions to provide information, it will make it more difficult for state-owned investors to promote equity repurchase.

Moreover, if the buyback period stipulated in the common form of the buyback clause is obviously shorter than the reasonable period required for the whole cycle of the state-owned equity buyback entry transaction, the buyback obligation objectively cannot complete the buyback arrangement within the agreed period, and the starting date of the liquidated damages/late fees will be disputed, and the agreed method will be changed to another negotiation. It will again make it more difficult for state-owned investors to push forward share buybacks.

In order to protect the rights and interests of state-owned investors, the author suggests that the state-owned equity repurchase approach transaction procedure should be listed as the agreed items in the repurchase terms, and strengthen the relevant obligations of the winning company and the repurchase obligor in this procedure, and set a number of liquidated damages/late fees. If the target company fails to cooperate to complete the equity evaluation and audit within a certain period of time, it can be regarded as a breach of contract and shall pay liquidated damages/late fees.

02. Dispute over the validity of repurchase terms

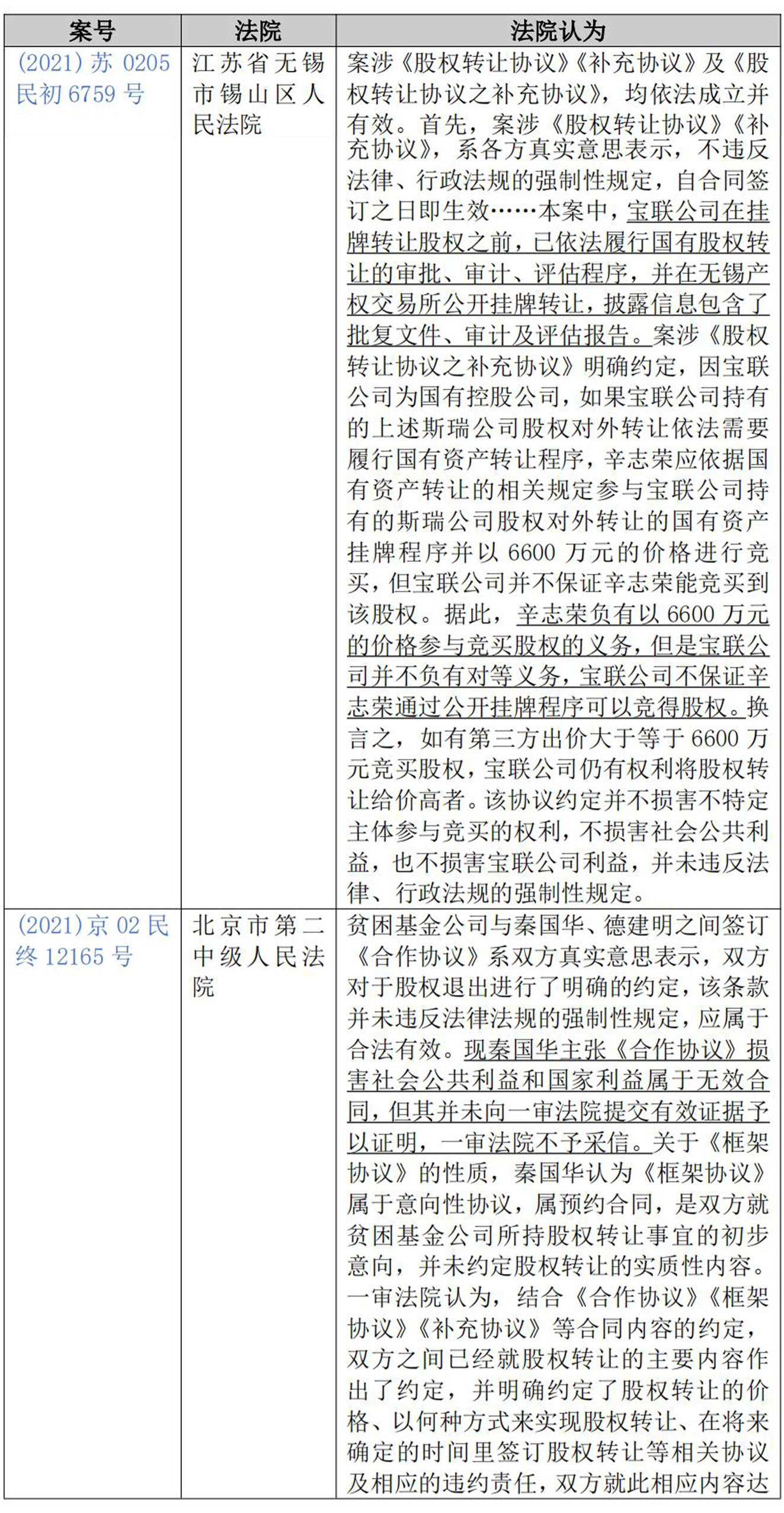

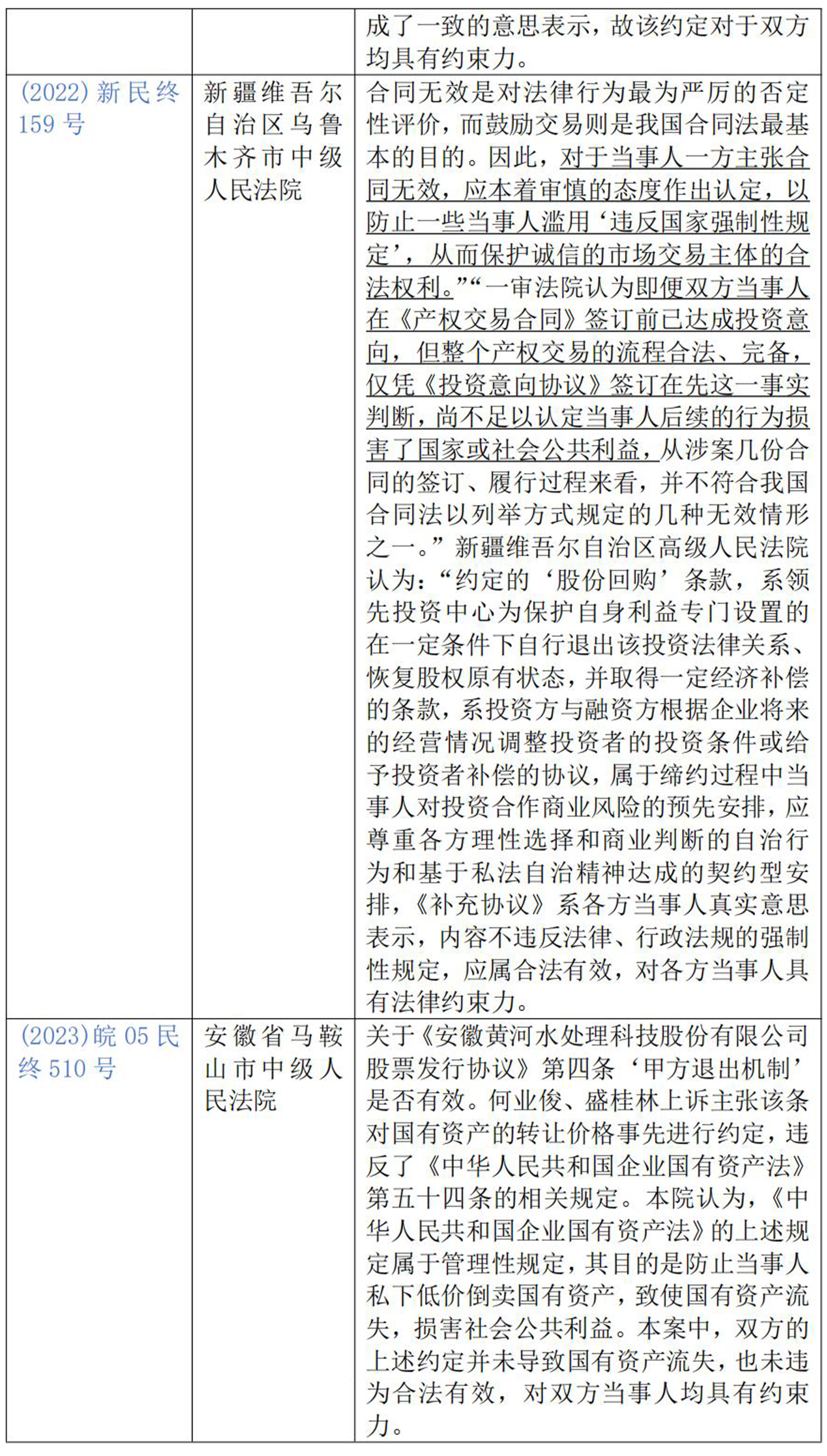

After searching the relevant cases, the following are excerpts of some cases in which the court upheld the validity of the repurchase agreement (clause).

Based on the above cases, the author believes that in order to obtain a favorable judgment or award in dispute resolution, state-owned investors should pay attention to the agreement of the repurchase agreement (terms) in the transaction documents in line with the regulation of state-owned assets and protect the interests of the public. It is recommended that the state-owned investor agree in the repurchase agreement (clause) that if the transfer of the equity held by the state-owned investor needs to perform the transfer procedure of state-owned assets, the company and the actual owner shall cooperate in accordance with the relevant provisions of the transfer of state-owned assets, including but not limited to submitting true, accurate and complete audit and evaluation materials. Repo obligor (usually the actual controller) has the obligation to bid for the state-owned assets listing procedure at an amount not lower than the agreed repurchase price (the higher value of the investment fund plus the fixed investment interest rate and the equity evaluation price), but the investor does not guarantee that the repo obligor can compete for the equity through the public listing procedure, so as to ensure the compliance of the repurchase procedure. Ensure that the bidding process does not infringe on the public interest. At the same time, in the supplementary agreement (or intent agreement) between the investor and the company and the repurchase obligor (usually the actual controlling person), the parties may consider agreeing that if a third party (including other existing shareholders) bids for the target equity at an amount higher than the repurchase price and completes the equity transfer and delivery, the repurchase obligation of the repurchase obligor under the investment agreement will be automatically terminated. Notwithstanding the above agreement, the investor may also consider setting up another liability clause for breach of contract, such as the repo obligor who fails to pay the deposit and does not participate in the auction shall be liable for breach of contract and compensate the investor. Under such circumstances, even if a third party (including existing shareholders) bids for the target equity, it will not exempt the repurchase obligor from the aforementioned breach of contract.

03. The repo obligor refuses to fulfill the repo obligation

(2021) Xiang 0211 Civil Judgment No. 5284 of the first instance at the beginning of the Republic of China, "The defendants Li Jiansheng, Yang Yan and the third party Sante Company claimed that the case involved the Supplementary Agreement, if the agreed buyback conditions have been achieved, the plaintiff will be in accordance with the state-owned assets disposal procedures, publicly listed its third party shares on the state-owned property rights open trading platform." The two defendants and the third party claim that the equity involved in the case is not listed for public transfer, and directly bring the case, the procedure does not meet the regulations." The Tianyuan District People's Court of Zhuzhou City, Hunan Province held that: "The equity value of the case is determined on the premise that the equity is listed in the public trading market, and the evaluation of the equity value must be based on the financial and accounting status of the target company. The plaintiff has informed the two defendants and the third party that the agreed equity repurchase situation has occurred on November 17, 2021, and therefore requires the two defendants to fulfill the equity repurchase obligation. That is, Sante Company and its actual controller (shareholder) Li Jiansheng and Yang Yan are requested to fully cooperate with the audit and evaluation work and truthfully provide the relevant information required for the audit and evaluation. Audit and evaluation agencies Walkerson (Beijing) International Asset Evaluation Co., LTD and Tiancheng International Accounting Firm visited Sante Company in November 2021. Because Sante Company did not provide relevant materials required for audit and evaluation, the evaluation and audit work could not be carried out. On December 17, 2021, the two agencies issued further notification letters to the two defendants and Sante Company on requiring them to submit all the information required for the audit evaluation before 17:00 on December 25, 2021, and according to the provisions of Article 159 of the Civil Code of the People's Republic of China, conditional civil legal acts, If a party improperly prevents the fulfilment of a condition for his own interests, the condition shall be deemed to have been fulfilled; Where a condition is improperly facilitated for its achievement, the condition shall be deemed to be unfulfilled. After repeated urging by the plaintiff, the two defendants and the Sante Company failed to submit their shares in due time, resulting in the fact that the involved shares (repurchase shares) have not yet completed the procedures for public listing and transfer on the state-owned property rights open trading platform, which should be regarded as improperly preventing the achievement of the repurchase conditions for their own interests and deemed to have been achieved." Accordingly, the court ordered the defendants Li Jiansheng and Yang Yan to pay the plaintiff the share repurchase funds, liquidated damages and attorney's fees within 10 days from the effective date of this judgment.

In the above cases, the court held that the defendant "improperly blocked the achievement of the repurchase conditions for its own interests, and deemed the repurchase conditions to have been achieved", based on the fact that the defendant unreasonably blocked the plaintiff from entering the transaction, thus making it bear the adverse consequences. However, at the same time, regarding whether it is reasonable for the court to overstep the "entry transaction" by "considering the repurchase conditions to have been achieved" in essence, the main concerns are as follows: If a third party buyer is willing to bid for shares at a bid price higher than the buyback price, it may lead to the failure to obtain a higher selling price for the transfer of state-owned assets, resulting in indirect loss of state-owned assets. In particular, early investors need to consider whether there may be situations where the value of the shares has exceeded the buyback price after the appreciation. However, the author also believes that if the fair value of the equity assessment has far exceeded the buyback price, then the real controller should have enough willingness to buy back at this time, or the third party is optimistic about the company to take the initiative to offer olive branch, in this case, the investor and the company, the real controller into the dispute resolution stage is less likely. Therefore, the author believes that investors entering the dispute resolution stage should reasonably have exhausted other exit channels, and finally can only ask the repo obligor to undertake the repurchase obligation through litigation or arbitration. In this case, the court ruled that the repo obligor "improperly prevents the repurchase conditions from being fulfilled for its own interests, and it is considered that the repurchase conditions have been fulfilled". Therefore, it is reasonable to pay buyback price and liquidated damages directly to investors.

04, equity repurchase other risk tips: the agreement on the repurchase obligation

(2022) Xinmin End 159 second instance civil judgment shows that due to the agreement that Rising Sun Environmental Protection Company (the target company) is the repo obligor and Zhang Juhuang (the actual controller) is the joint guarantor, the company's performance of the buyback obligation is subject to the shareholders' meeting to review the company's capital reduction, and the company is a prerequisite for the performance of the capital reduction procedure. The court of first instance held that "the company's capital reduction procedure is a matter of internal autonomy, judicial intervention is not appropriate, and it is not actionable in trial practice", and rejected the plaintiff's lawsuit request. The Court of second instance held that: "The behavior of Rising Sun Environmental Protection Company to buy back shares should be a case of reducing the company's registered capital, so the prerequisite for Rising Sun Environmental Protection Company to buy back shares should be resolved by the general meeting of shareholders, and in accordance with the provisions of Article 177 of the Company Law of the People's Republic of China to complete the capital reduction procedure." In fact, whether the equity repurchase agreed in the Supplementary Agreement can be performed objectively exists a variety of possibilities, rather than an inevitability. It is uncertain whether the share repurchase has been approved by more than two-thirds of the voting shareholders, whether the target company has completed the capital reduction procedure, and whether creditors agree. Therefore, in the case that Rising Sun Environmental Protection Company has not completed the capital reduction procedure, the court of first instance found that Rising Sun Environmental Protection Company has not completed the pre-procedure of the target company's share repurchase. ... Zhang Juhuang is the debt guarantor for the share buyback of the Rising Sun Environmental Protection Company, and the leading investment Center also claims that Zhang Juhuang bears joint and several payment liability in this case. From the analysis of the legal relationship of the guarantee, the obligation of the guarantee contract is subordinate, that is, the prerequisite for the performance of the guarantee contract obligation is that the conditions for the performance of the main contract obligation have been fulfilled. In view of the fact that the capital reduction procedure of Rising Sun Environmental Protection Company has not been completed, the conditions for the performance of the main contract obligation of share repurchase have not been fulfilled, so Zhang Juhuang has not fulfilled the conditions for the performance of the guarantee obligation. The leading investment center appealed that the reason that Zhang Juhuang assumed joint and several guarantee liability could not be established, and the court did not support it. The court of first instance's failure to order Zhang Juhuang to bear joint and several guarantee liability is improper, and this court uphold it.

In the above cases, even if the courts of first and second instance both recognize the validity of the repurchase agreement, since the repurchase clause stipulates that the target company is the repurchase obligor and the actual controller bears joint and several guarantee liability, the investor will encounter difficulties in requiring the company to fulfill the repurchase obligation and the actual controller to bear joint and several guarantee liability when the shareholders' meeting of the company fails to pass the capital reduction resolution. The author understands that in the process of negotiation of transaction documents, the two sides of the transaction often go through several rounds of negotiation on core clauses such as buyback clauses, and the fine-tuning of the expression of individual clauses may produce completely different legal consequences. The author suggests that investors should strictly review the buyback clauses of the core clauses when the transaction documents are formulated. In order to protect the rights and interests of investors, it is suggested that the repurchase obligation should include both the target company and the actual controller.

05. Other risks of equity repurchase: Agreement on the subject of repurchase

(2022) Beijing 02 Min End 2069 civil judgment of second instance shows that the court of first instance held that: "Compared with the bidding object 'NORd holds 100% equity of Jinke Company' agreed in the Agreement of Intent, the formally disclosed equity transfer information has attached a huge amount of creditor's rights transfer of the transferor NORd Company, and this additional condition has caused a fundamental change in the transfer base price, because the transfer object and price are the core terms of the contract. Since NORd changed the agreement without authorization, Junyuan's non-participation in the auction does not constitute a breach of contract, and its request for NORD to return the deposit and pay interest is justified, and the court of first instance upheld it. The court of second instance agreed with the above view and upheld the original judgment.

The author suggests that state-owned investors should clarify the specific subject matter of the repurchase agreement (terms) when signing the repurchase agreement (terms). If new claims are formed after the capital increase, the repurchase agreement (terms) should be changed simultaneously. Similarly, if the underlying company is subsequently restructured or exchanged shares, shareholders' rights and interests should be sorted out and signed the corresponding legal documents in a timely and comprehensive manner, so as to ensure the accuracy and effectiveness of investors' repurchase requests.

To sum up, in order to prevent the parties from getting into a negotiation deadlock, the written agreement on the repurchase terms of the investment agreement is particularly important, which should not only include the state-owned equity repurchase

Recommended Information

-

HonorsChen Shanyong, lawyer of Dehehantong, was selected into the Lawyer Expert Bank of the Rule of Law Daily in 20242024-07-01

-

UpdatesDehehantong successfully entered the Treasury Sinofin Securities Co., LTD2024-07-01

-

ArticlesAccording to the case: Rules for the judicial protection of juvenile crime cases2024-07-01

-

UpdatesDehehantong Law Offices Shanghai, Chengdu, Taizhou, Hengqin office exchange activities successfully concluded2024-06-27

-

HonorsThe list was announced, and a number of Dehehantong lawyers were elected members of the 12th Shanghai Bar Association Professional Committee2024-06-25